How

George Bush Destroyed The U.S. Economy

...And The Congress That Let

Him

September 27. 2007

George Bush is shaping up to be the Britney Spears of

Presidents. Start off strong, but shaky, substance and position questioned, then crash and burn.

Some believe he

won the election, some believe he did not. It was a lip sync victory for some.

All that's left for him to do now is flash, which I trust he won't He proclaimed faith in God, even referring to himself as a

Christian, but his conduct in very important matters has been anything but.

The war has claimed many lives and usurped over 1 trillion in tax dollars, with the

President requesting tens of billions more. Congress, inexplicably, has given

him a blank check, underwritten by your tax dollars, for a war the White House

lied to the public regarding.

If he had told people what he was truly doing with that war they

would have told him: you can't control that rambunctious region nor its

assets and you're going to send the U.S. economy in a terrible tailspin, from

which it may never fully recover. But, moving on from the spilled blood milk for a

second. Let's look at some other lesser, but important factors, in where the

nation is headed.

Record Number Of Citizens Lose Their Homes To Foreclosure

This year a record 3 MILLION Americans have lost their homes,

breeding the worst mortgage crisis in U.S. history that George Bush does not

have the mental capacity to fix. Said mortgage crisis has caused foreign banks with a culminated

trillions in assets to pull out of American financial institutions, freeze

assets abroad and adopt a, "We're not lending you anymore money until we see

where this crisis is going" attitude.

U.S. Dollar Declines

The U.S. dollar has decreased in value. So much so that the Euro

and Pound have soared and last week, the Canadian dollar caught up with the U.S.

dollar for the first time since 1976. That can be interpreted as erasing 30

years of progress.

Bush In Denial

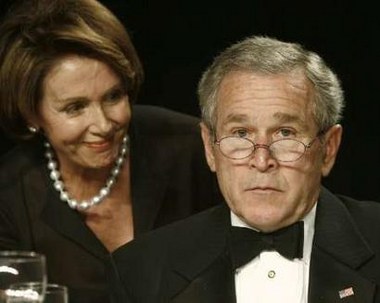

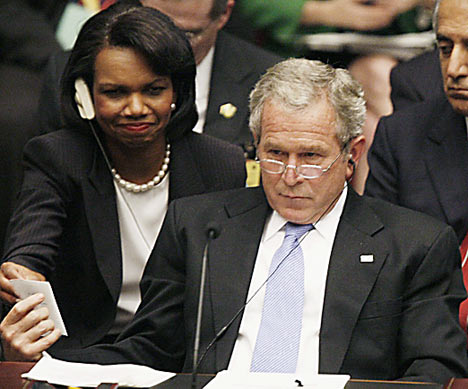

President Bush Busted Using Crib Sheets

Yale all over again, I see.

Over the last month, economists who don't use crib

sheets, have rendered some dire predictions as to where they think the

economy is headed. Yet Bush in his weekly radio addresses continues to declare the economy is

"strong." Which economy are you looking at? You do realize the £ is not the

same as the $ sign. Citizens are suffering. There is no way Bush's

daze of denial is going to help matters. Since when did denial ever solve a

problem.

At the

beginning of the 20th century, the world entered it with Britain being number

one. By the end of the 20th century, America was number one. Citizens and

immigrants from all over, engaged in free enterprise, started businesses and

became success stories, and thus the American Dream

was born.

You however, Mr. Bush, adopted a terrible financial philosophy

on how to run a country...into the ground. You started a costly deceitful war,

spent money like it was going out of style and took care of the corporations

that were trampling the citizens.

Banking Industry Allowed To Gouge And Swindle Citizens

You left the banking industry unregulated at the worst possible

time in history - during the country's most expensive war. There were credible

reports coming out from all over the country of deceitful banking practices

gouging citizens and swindling their homes and you did nothing.

Because in your mind, corporations and big business come first, which is a stupid financial

motto, but clearly one you live by. Banks took predatory lending to new extremes during your

administration. They knew the ally they had in you and gouged the financial life

out the country's citizens.

Americans were enticed with low introductory new loan and

refinance rates, didn't grasp

what they were truly signing and now people who had $600 mortgages are being

told THIS YEAR their new mortgage payment is $1,800 per month. How do you expect

them to pay that or do you just not give a hoot because your bills are paid.

I know people that this has happened to. There were even people

on the national news protesting that they are going to lose their homes to this. MANY

CITIZENS ALREADY HAVE. The banks are putting the squeeze on citizens all over

the country, left, right and center. But you, Mr. President, allowed these banks to prey on citizens,

because in your eyes big business can do no wrong. Well guess what, they can...and they have...and now it's

effecting the country's bottom line:

Terrible Economic Ripple Effect

This historic mortgage crisis has created a terrible ripple effect. Home builders

are going under, as they have built homes people aren't buying. People can't afford

it, as the cost of living in the country has risen due to the war.

Higher Cost Of Living

The war has driven up the cost of living via added food and gas

costs and that's in addition to you raising many fees across the country for

government services to pay for said war. It's a vicious cycle that you initiated

with your deeds.

Bad Credit

Many Americans now have bad credit after you allowed all that

unprecedented predatory lending to take place that cost millions of citizens the homes they did

have - while others were swindled out of their properties via mortgage scams and

unscrupulous municipality boards, as you twiddled your thumbs and watched

Iraqi oil...and blood flow.

Therefore, with bad credit, how are citizens going to buy new

homes to replace the ones they lost. And your nonsensical excuse last month that

the government is not going to bail out people who bought homes they couldn't

afford holds no water and contradicts facts.

So, you're saying the 3 million foreclosures so far this year

are 3 million irresponsible Americans who bought homes above what they could

afford and not people who were scammed out of their homes as FBI stats suggest,

while others were taken advantage of by predatory lenders, who out of nowhere

tripled the figure of their mortgage payments this year, as news reports

suggest.

One of my friends was paying $380 per month last year. She is

now paying $980 with a nasty Washington Mutual bank rep even sniping "we are not

obligated to send you a statement" regarding the payment hike. Another friend, whose mortgage is with another bank, got the

shock of her life today when she opened her mail, only to find out that after 15

years of home ownership with payments of

$450 per month, her payment has shot up overnight to

$1,800 per month.

And this is the story of many all across America with banks

putting the squeeze on citizens to compensate for this mortgage crisis. One that

the President and Congress allowed to happen, that is hurting millions of

Americans. I started writing about this issue last November in my

Sound Off Column

and if I saw this disaster coming why didn't they. After all, they're supposed

to be the professionals, right.

Industries In Trouble

The crisis is breeding the fall of a few industries. Home builders, furniture stores and ironically, mortgage companies.

For

further reference on the latter, see predatory lender Countrywide that almost folded

with 28,000 employees until Bank Of America sent a cash infusion. See Eagle

First Mortgage and its 75 branches that were shutdown for "illegal lending

practices" that defrauded Americans. Also see American Home Mortgage that

folded, leaving 6,000 people out of work.

But earlier in the year, what was the FBI's little dingbat

reasoning for this unexpected mortgage crisis: oh, rogue independent citizens are trying to

take advantage of our lucrative real estate market. Yea, they were part right -

they just left out the unscrupulous banks.

Home Builders Going Under

Recently, there was a developer that borrowed $110,000,000 from

a bank to build a condo building on popular Miami Beach. This year he had

to walk away from the condo building after failing to sell even a single unit.

The bank then foreclosed. His business in ruined. That's a true picture of what

the economy is like

now.

Furniture Stores In Financial Straits

Furniture stores worth billions are in financial trouble,

some closing, because people aren't buying furniture to put in the homes they aren't buying

from the builders. Once again, a vicious cycle.

Farmers

The farmers are feeling the heat with the President running away

undocumented migrant workers. They can't afford to pay others to help them run

their farms that feed the nation.

Unemployment

With businesses going under in the mortgage crisis, that means jobs are lost, which can

cause unemployment to skyrocket. That's not good for any economy. But you, Mr. President, clearly don't grasp that, because you

continue to spout your "the economy is strong" speech, while standing

idly by as the crisis worsens.

Bush Administration Accused Of Rigging Big Tobacco Verdicts

Former U.S. Attorney Sharon

Eubanks

Another example of this practice of yours in looking out for the

corporations at the citizens' expense is illustrated in Big Tobacco. Last month, I read an

excerpt of a book regarding how you "rigged Big Tobacco verdicts" via the court

system to benefit your "Big Tobacco friends" in Texas.

Never mind tobacco killed off scores of Americans, who did not

know how dangerous those little cancer sticks really were. But Big Tobacco knew,

they had advance warning....but they didn't bother to let everyone else in on

what they'd discovered. Rather than punishing them and giving the money to cancer

victims who smoked for years, you protected the corporations. A U.S. attorney,

Sharon Eubanks, even spoke out and stated she was instructed to rig award amounts to victims,

reducing them by tens of billions of dollars, to protect Big Tobacco. That is

unconscionable...and on your shift, Mr. President.

Enron

Then there's Enron. Credible news pieces have stated that

because you and your family are friends with the two CEOs of Enron and their

families, they were allowed to continue running that farce of a business. Rather than stopping the madness, when there were so many

terrible warning signs, it was allowed to continue

until it culminated into the biggest corporate disaster in U.S. history. Enron hurt many Americans, whose pensions

and savings were wiped out.

I saw a 55 year old woman on TV that lost her pension in the

whole Enron scandal. She dishearteningly stated she has to work for 10 more

years rather than retiring now, as she had planned to do. Her dreams of retiring with the money she EARNED was destroyed.

She was cast into financial uncertainty. Many share her story, while Enron's

executives, your friends, had cashed out to the tune of millions.

But once again, you believe in protecting the corporation,

rather than the citizens and it has become a hallmark of your presidency that

history certainly will not forget. It has further come back to burn your administration in a

terrible way, as you now have the dubious distinction of being the president

when America hit unprecedented financial lows.

The Middle Class Is Disappearing

The American middle class has just about disappeared. Many

writers have noted this. It is now rich and

poor, when before America had a very strong middle class.

Where This Is All Headed

What is forming is a similar situation to what happened in

India, respectfully, with a small group of rich and a large group of poor. Unemployment is going to skyrocket if the government is not

careful.

Bad Financial Ideas

I don't know who it is that put the idea in your head, Mr.

President, that

protecting corporate interests at the expense of a country with 300,000,000

citizens was the best course of action, because it wasn't. If citizens are broke, struggling to pay bills, losing their

homes, they will spend less in the marketplace run by corporations and perform

poorly at work at corporations.

You threw ethics out the window and let these corporations do

whatever they wanted to the country's citizens and now the treasury is paying a

price for it. You spent whatever you wanted, whenever you wanted as well, and now the seeds of

these terrible decisions are sprouting up all over, threatening to consume the

country financially.

You are going to go down as the worst president in U.S. history,

but clearly you don't grasp what that truly means or you wouldn't have done half

the bad things you did.

Senate agrees to raise U.S. credit

limit

WASHINGTON, Sept 27 (Reuters) - With

the U.S. government fast approaching its current $8.965 trillion credit limit,

the Senate on Thursday gave final congressional approval of an $850 billion

increase in U.S. borrowing authority. The Senate voted 53-42 to raise the

debt ceiling to $9.815 trillion, the fifth increase in the U.S. credit limit

since President George W. Bush took office in January 2001.

"We have no choice but to approve

it. If we fail to raise the debt ceiling soon, the U.S. Treasury will default

for the first time in its history," said Senate Finance Committee Chairman Max

Baucus.

http://today.reuters.com/news/articleinvesting.aspx